12 Essential Accounting Concepts You Need to Know for POA

PURPOSE

Accounting principles or concepts are set up to ensure all business standardise accounting definitions, assumptions and methods when recording transactions in the business

| Accounting concept | Definition | Frequently tested in |

| Materiality Concept | Requires the disclosure of information which is deemed to be material in accounting reports.

Information is deemed to be material if it has a serious effect on the decision-making those who use it. |

Capital and revenue expenditure |

| Prudence Concept | States that business should understate profits or assets of the business. Hence all expected losses are expected to be reported but not all expected gains are reported. | Depreciation, Impairment of trade receivables, Inventory |

| Consistency Concept | Requires an entity to use the same accounting methods and procedures from period to period to enable meaningful comparison over time. | Depreciation |

| Matching Principle | States that expenses incurred in a given period must be matched against income to determine the profit or loss for the period. | Depreciation, Impairment of trade receivables, Accruals and prepayments |

| Accrual Concept | Requires all revenues and expenses to be taken into account for the period in which they are earned or incurred regardless whether cash is received or paid | Accruals and prepayments |

| Accounting Period Concept | Divides the life of a business into equal time periods for financial reporting. | Income Statement

Balance Sheet |

| Going Concern Concept | Assumes that a business has indefinite economic life. | |

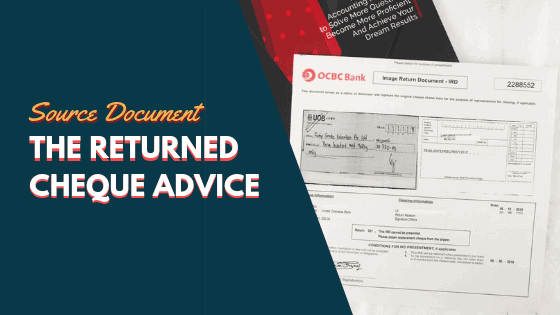

| Objectivity Concept | States that transactions are recorded based on information that is reliable and verifiable i.e. they must be supported by source documents or evidence. | Source Documents |

| Historical Cost Concept | States that transactions are recorded at their original cost which is reflected in their source documents | Non-current assets |

| Monetary Concept | States that only transactions that can be measured in money terms are recorded. | |

| Accounting Entity Concept (business entity) | States that the business is an entity separate from its owners and only business activities are to be recorded in its books. | Business entities |

| Revenue recognition | Revenue is earned when goods have been delivered or services have been provided |

How are Accounting Concepts Tested In POA Exams?

Accounting principles are often tested as part of the theory aspect of the exams.

Three types of questions are commonly tested for accounting theory in any Sec 3 or 4 weighted assessment or term tests:

a. Explain the accounting concept – Define the accounting concept in the question.

b. Identify the accounting concept adopted – Understand and apply the accounting concept underlying the situation given in the question.

c. State the accounting concept violated

Examples of Accounting Concepts tested in POA Exams

For each of the following statements below, state the accounting concept/principle and whether it has been followed or violated.

Example: Financial statements are prepared with the assumption that the business will operate indefinitely.

a) A sole proprietor bought a present for his niece paying from the business bank account. This amount was recorded in the Drawings account.

b) The boss of a restaurant argued that utilities not paid for the month should not be recorded in the books until it is paid, post year end.

c) The cost incurred in earning the income for the current accounting period should all be recorded in that same accounting period.

d) Gideon did not immediately reflect in his books that one of his trade receivables became bankrupt

e) Goods sold but undelivered to the customers have been treated as Sales Revenue in the business books.