2017 7175 GCE O Level POA Suggested Solutions

Hey folks!

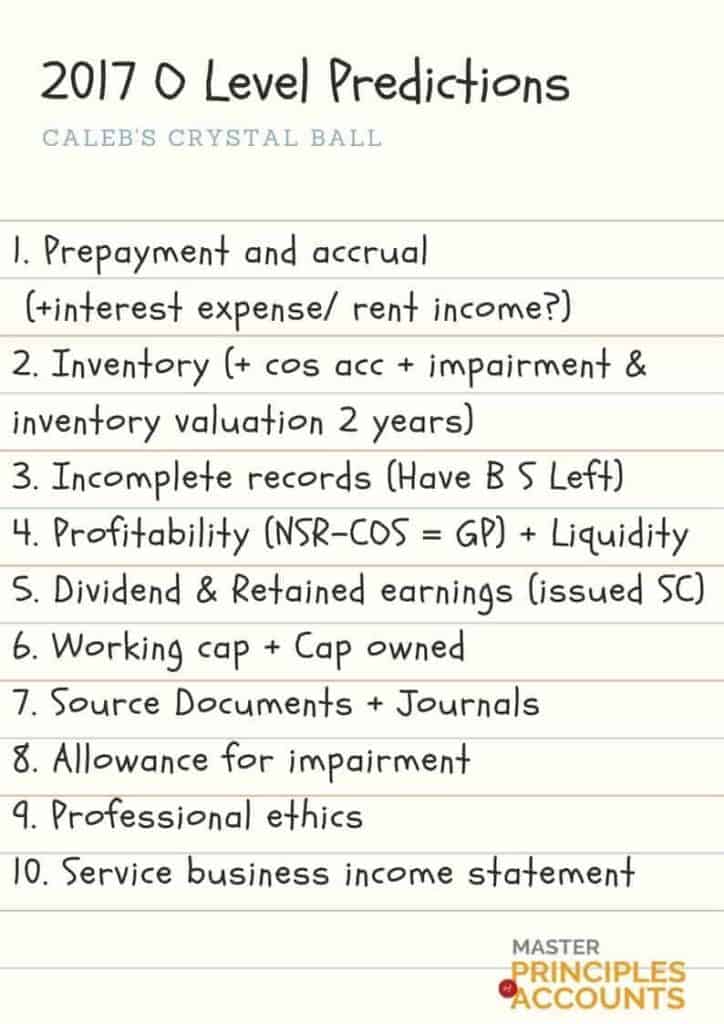

The solutions are out! This year predictions are pretty on point. 2 misses though.

Download the solutions with the button here

How suitable the depreciation method is on an asset depends on how well it reflects the economic reality of the utility of the business’ assets. In the real world, screw it. Straight Line Method is used for its simplicity. 🙂

You just finished your final year examinations and are considering your options. The familiar arts (history, literature or geography) and science (biology, physics and chemistry) Principles of Accounts (POA) sounds so foreign and you’ have heard from friends that it is boring. But there’s more to debits and credits in POA. “’Double-entry bookkeeping’ is one…

There are several methods of depreciation used across different financial reporting standards around the world. For the 7175 and 7088 GCE O/N Level Syllabus, we focus on two specific methods: 1. Straight Line Method (SLM) 2. Reducing Balance Method (RBM) Methods Advantages Disadvantages Effect on Net Profit Straight Line Method a. Dep = (HC-SV) Useful…

Unlike errors made in school homework, bookkeepers cannot undo errors using correction tape. Whenever errors in recording transactions occurs, bookkeepers will use correcting double entries to make right the errors. Correction of Errors The trial balance is designed to detect certain errors and not others. In this article, we look at two types of errors:…

It might seem obvious, but in managing a business, it’s important to understand how the business makes a profit. A company needs a good business model and a good profit model. A business sells products or services and earns a certain amount of margin on each unit sold. The number of units sold is the…

Gross Profit is calculated by deducting the cost of goods sold from the net sales figure. The calculation of the gross profit takes place in the trading account. Net Profit – the excess of gross profit over expenditure. it is calculated in the profit and loss account by deducting all business expenditures from the gross…

Register early and lock in S3 rates and your preferred time slots for 2026 classes! Try out our Headstart classes to bridge S3→ S4 gaps.

Program Coordinator

I will be back soon