2015 O Level POA Answers

Congratulations to all Jump Grades’ students!

We’ve been slogging it out over the past week focussing on the key chapters we were spotting that might come out for Os:

At Jurong East:

At Macpherson (Bedok + Kovan Students)

DAY BEFORE EXAM CAMPING AT SAIZERIYA:

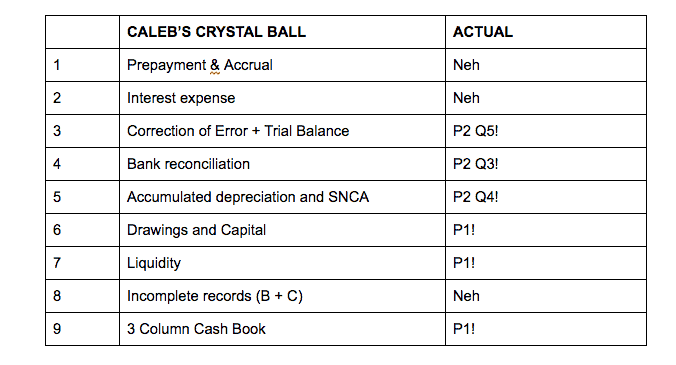

The results are out. Comparing Caleb’s guess vs what came out. It’s not too bad:

Alright. Here you go. My SUGGESTED solutions attached. If you find any errors, please feel free to let me know in the comments section below or via whatsapp (better!) – Caleb

Paper 1 :

ai) Purchases journal

aii) General journal

aiii) General Journal

aiv) Cash Book

b)

Trade payables control account

| Date | Particulars | Dr | Cr | Bal |

| 2015 | $ | $ | $ | |

| Jun 1 | Balance b/d | 15400 Cr | ||

| 30 | Inventory | 84500 | ||

| Cash at bank | 77000 | |||

| Trade receivables control (contra) | 1100 | |||

| Discount received | 84 | |||

| Interest expense | 350 | 22066 Cr | ||

| Jul 1 | Balance b/d | 22066 Cr |

ai)

Tan Chin’s account

| Date | Particulars | Dr | Cr | Bal |

| 2015 | $ | $ | $ | |

| Jul 1 | Balance b/d | 2800 Dr | ||

| 3 | Sales | 3200 | ||

| 15 | Cash at bank (95% x 2800) | 2660 | ||

| 15 | Discount allowed | 140 | ||

| 20 | Sales | 960 | ||

| 23 | Sales returns | 625 | 3535 Dr | |

| Aug 1 | Balance b/d | 3535 Dr |

aii) Current assets: presented as trade receivables

b) Record returns of goods from customers.

c) To acknowledge returns of goods of a customer.

di) Total sales of $7240 will be posted to the credit of sales account.

dii) General ledger.

a)

Kim:

Gross profit margin = (Profit + Sales revenue) × 100%

= (21 300 ÷ 154 000) × 100%

= 13.83%

Chan: Gross profit margin = (Profit + Sales revenue) × 100%

= (24 500 ÷ 193 000) × 100%

= 12.69%

b) In terms of absolute figures, Chan’s gross profit and profit for the year are both higher than Kim. This is due to Chan’s much higher sales revenue of $193 000 as compared to Kim’s sales revenue of $154 000.

However, in terms of ratio, Kim’s profit margin of 13.83% is higher than Chan’s profit margin of 12.69%. This shows that Kim is able to earn a higher profit for every dollar of sales revenue earned as compared to Chan. This is largely due to Chan’s higher expenses of $81 000 as compared to Kim’s expenses of only $54 000.

a)

Inventory account

| Date | Particulars | Dr | Cr | Bal |

| 2015 | $ | $ | $ | |

| Sep 1 | Earl Hock | 35700 | ||

| 9 | Cost of sales | 24000 | ||

| 15 | Geeta | 22000 | ||

| 24 | Cost of sales | 27800 | 5900 Dr | |

| Oct 1 | Balance b/d | 5900 Dr |

b)

Cost of sales account

| Date | Particulars | Dr | Cr | Bal |

| 2015 | $ | $ | $ | |

| Sep 9 | Inventory | 24000 | ||

| 24 | Inventory | 27800 | 51800 Dr | |

| 30 | Trading account | 51800 |

c)

Sales revenue account

| Date | Particulars | Dr | Cr | Bal |

| 2015 | $ | $ | $ | |

| Sep 9 | P Tham | 45600 | ||

| 24 | Zahir | 53000 | 98600 Cr | |

| 30 | Trading account | 98600 |

b) Name: Prudence theory

Explanation: The lower value of inventory is recorded as assets should not be overstated and any possible expenses or losses should be recorded.

Paper 2 :

Adi

Statement of financial performance for the year ended 30 June 2015

| $ | $ | |

| Sales revenue (311380 + 3400) | 314780 | |

| Less : cost of sales | 156460 | |

| Gross profit | 158320 | |

| Less : Other Expenses | ||

| Freight charges | 230 | |

| Wages | 94300 | |

| Insurance (5200 – 800) | 4400 | |

| General expenses | 14900 | |

| Impairment loss on trade receivables | 850 | |

| Interest on loan (9000 x 8% x 3/12) | 180 | |

| Depreciation on motor vehicles ((110000 – 21000) x 20%) | 17800 | |

| Depreciation on fixtures and fittings (35500 x 15%) | 5325 | |

| 137985 | ||

| Profit for the year | 20335 |

Adi

Statement of financial position as at 30 June 2015

| Assets | $ | $ | $ |

| Non-current asset | cost | Acc. dep. | N.B.V |

| Motor vehicles | 110000 | 38800 | 71200 |

| Fixtures and fittings | 35500 | 12925 | 22575 |

| Total non-current assets | 93775 | ||

| Current assets | |||

| Trade receivables (20110 + 3400) | 23510 | ||

| Less: Allowance for impairment on trade receivables | 850 | 22660 | |

| Inventory | 24500 | ||

| Prepaid insurance | 800 | ||

| Total current assets | 47960 | ||

| Total assets | 141735 | ||

| Equity and liabilities | |||

| Owner’s equity | |||

| Capital(123400 + 20335 – 25400) | 118335 | ||

| Total equity | 118335 | ||

| Non-current liabilities | |||

| Long term borrowings | 9000 | ||

| Current liabilities | |||

| Trade payables | 13020 | ||

| Bank overdraft | 1200 | ||

| Interest on loan payable | 180 | ||

| Total current liabilities | 14400 | ||

| Total equity and liabilities | 141735 |

a)

| 31 Dec 2012 | 31 Dec 2013 | 31 Dec 2014 | |

| Average inventory | (12000+18500)/2= 15250 | (18500+25500)/2= 22000 | (25500+28000)/2= 26750 |

| Inventory turnover rate | 63500/15250= 4.2 times | 71000/22000= 3.2 times | 77500/26750= 2.9 times |

bi) Despite the increase in cost of sales over three years, Joe’s inventory turnover rate is on a declining trend from 4.2 times in 2012 to 3.2 times in 2013 to 2.9 times in 2014.

bii) From the increasing inventory balances for the three years, the reasons for the trend could be due to buying of more stocks or selling slower and obsolete stocks.

c) Inventory turnover rates can be improved by buying less so as to clear the existing inventory first and by giving discounts to sell more and faster.

a)

General journal

| Date | Particulars | Dr | Cr |

| 2015 | $ | $ | |

| Jul 31 | Dividend (200000 x $0.25) | 50000 | |

| Cash at bank | 50000 | ||

| Aug 1 | Cash at bank (80000 x $2.50) | 200000 | |

| Issued share capital | 200000 |

bi) Issued share capital on 1 Aug 2015 = $200000 + $200000

= $400000

bii) Retained earnings on 1 Aug 2015 = $70000 + $120000 – $50000

= $140000

biii) Total equity on 1 Aug 2015 = $400000 + $140000

= $540000

c) The two professional ethics which must be applied by accountants are:

- Integrity. That is being straightforward and honest in all professional and business relationships.

- Objective. That is to be unbiased when making professional judgement in the accounting process.

ai) Trade receivables are current assets arising from selling of goods on credit.

aii) Allowance for impairment on trade receivables is the identification of special customers whose debt may not be collectible in the immediate future. It is presented in the balance sheet as a deduction against trade receivables.

b)

Accumulated depreciation of motor vehicles account

| Date | Particulars | Dr | Cr | Bal |

| 2013 | $ | $ | $ | |

| Apr 30 | Impairment loss on trade receivables | 235 | 235 Cr | |

| May 1 | Balance b/d | 235 Cr | ||

| 2014 | ||||

| Apr 30 | Impairment loss on trade receivables | 137 | 372 Cr | |

| May 1 | Balance b/d | 372 Cr | ||

| 2015 | ||||

| Apr 30 | Impairment loss on trade receivables | 168 | 540 Cr | |

| May 1 | Balance b/d | 540 Cr |

c)

Statement of financial position as at 30 April 2015

| Current assets | $ | $ |

| Trade receivables | 27600 | |

| Less: allowance of impairment on trade receivables | 540 | |

| 27060 |

All the best for the rest of the papers!